Investing in mutual funds can be a smart move for almost all kinds of investor. Professional fund management, diversification and simplicity are the key benefits of mutual funds. We offer all the mutual fund schemes by virtually all the Asset Management Companies (AMCs) in the country. Anytime is a good time to invest in Mutual Funds if you follow the right strategies.

Fluctuation is the nature of the Market; Markets will continue to fluctuate, always, there will be surges and corrections in the market. Multiple strategies like Systematic Investment Plan (SIP), Systematic transfer Plan (STP) are available to make the best of market crashes and surges.

6 Simple Rules of Investing in Mutual Funds:

- Keep Portfolio lightweight: Mutual Fund is a diversified instrument and each scheme invests in multiple stocks. So focus on different style of investment keeping portfolio lightweight (6-7 schemes max) rather than investing in many similar schemes which dilutes the returns

- Maximize returns through asset class rebalancing strategy: Rebalance corpus from Debt to Equity during marker corrections to maximize returns

- Chase for consistency: Select consistently performing schemes as against temporary star schemes

- Align with goals: Set goals for disciplined investment; map investment to goals and follow de-risking approach when closer to goal

- Select schemes based on Investment Horizon and Risk appetite: Investment horizon and risk appetite are very important aspects while selecting the schemes

- Review Portfolio: Review schemes from time-to-time for rebalancing, if required

Typical Diversification in a Mutual Fund Scheme

When one invests money in a particular mutual fund, money gets invested into number of stocks selected by that particular fund. A well-diversified mutual fund may have 70-80 stocks where it invests money.

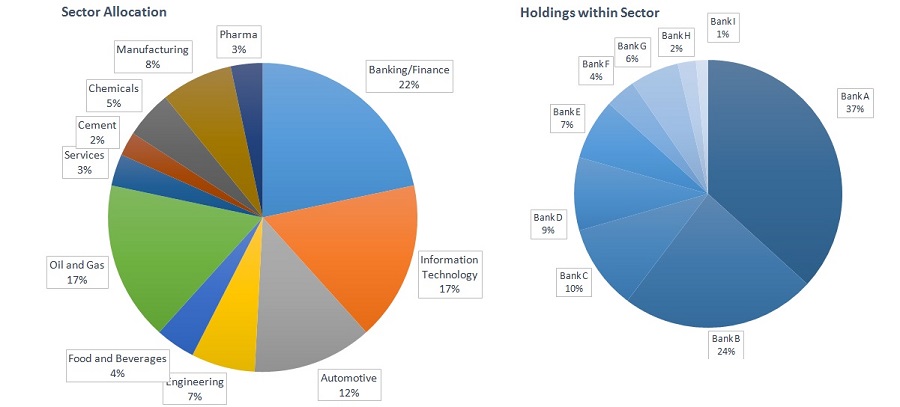

Diversification reduces sector specific or business specific risk significantly. For example, low/negative returns of few businesses does not significantly impact the overall return of fund as other businesses in portfolio continue to do well. This key feature of diversification along with professional management makes mutual fund a popular choice of investment. The picture below gives an idea of sector-wise diversification and business-wise diversification.

Magic of Compounding

“Power of compounding is the 8th wonder of the world” - Albert Einstein

Mutual fund has the ability to give significant capital appreciation to investor over the period of time due to compounding impact. The table below shows the returns on investment of INR 5,00,000/-, for a given interest rate over various time horizon.

Mutual Fund Investment Horizon

Mutual fund is about long term investment, investors who try to time the market tend to underperform investors who remain invested for long term. Investment in mutual funds should be done with a time horizon of minimum 4-5 years to have respectable returns. Following table provides an idea on type of fund and respective time horizon. One should select appropriate type of fund depending on how long he/she wants to stay invested in the market; otherwise there is a good probability that returns will be sub-optimal.

Risk appetite is an important aspect to consider when doing investment in mutual funds. Mutual funds investment are subject to market risk. Effective risk management includes choosing the right portfolio for investment