Enjoy your Retirement with HDFC Life Sanchay Plus. Get assured monthly income for 25/30 years and the entire premium back at maturity (plus 3% extra)

Key reasons to consider these fixed income plans for Retirement or Second Income

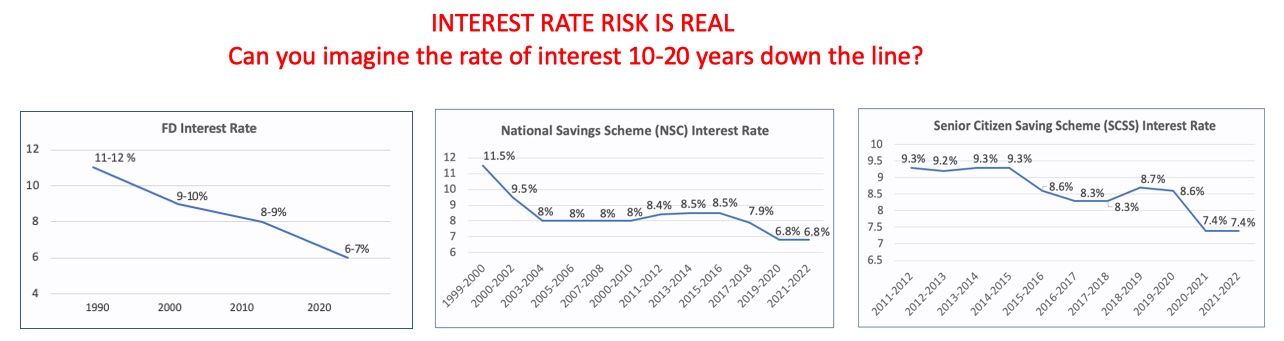

- Developing economy always poses a risk to interest rate, which is evident from declining interest rates in FD and small savings scheme for last 2-3 decades. Please refer to below figures for trend in interest rates.

With HDFC Life Sanchay Plus, you can lock-in superior tax-free (section 10-10D) rate of return for future, up to 6.82%; thus eliminating any future interest rate risk and a situation where you may have a corpus, but not attractive interest rates in FD and small saving schemes.

- Average interest rates in the world’s top 5 economies is 2%. India is 6th largest economy and current interest rate of 6-7% is already under pressure

- The Long term income variant covers a larger payout span of 25 or 30 years, with hassle free monthly credit to your bank account like second income or pension

- The yield of alternate instrument like Real-estate is low, approx. 2-3% across states in India + maintenance cost + tenancy issues + documentation & legal

Note: This plan is complementary to your equity portfolio, to bring the balance between guaranteed and non-guaranteed returns; while making decision comparison should be done with returns you get in debt funds, FD or other savings plan.

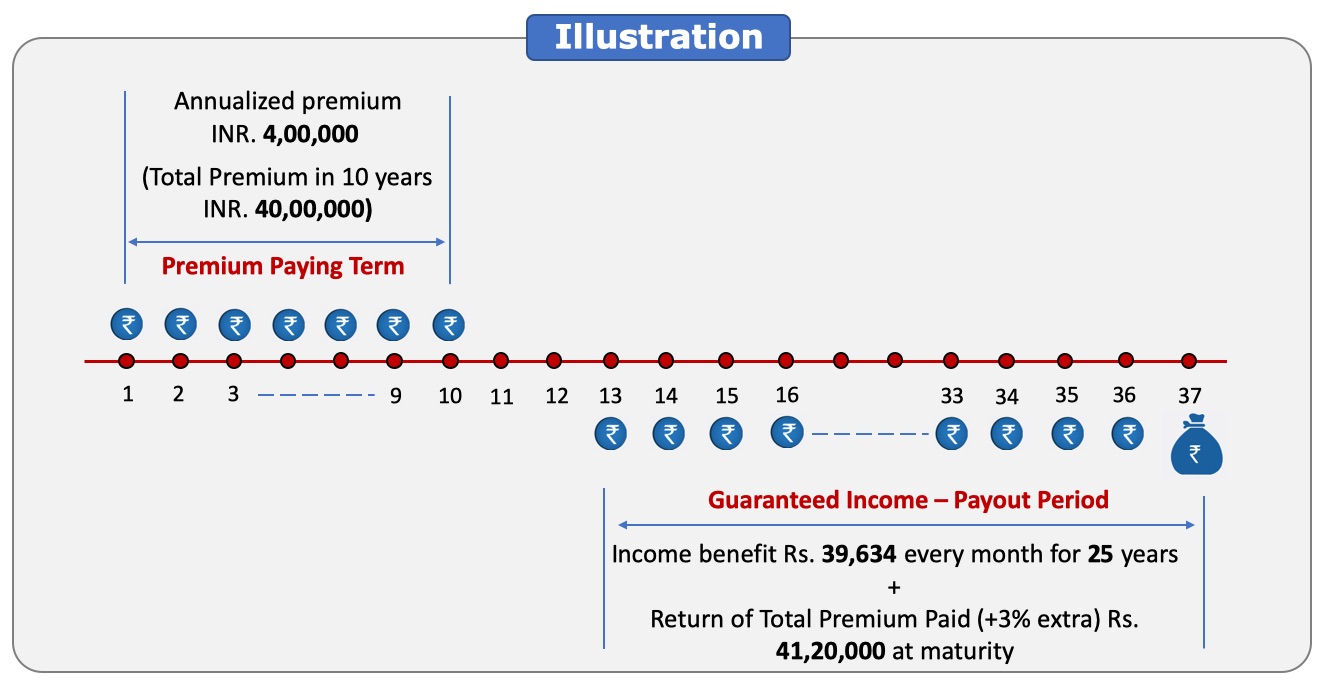

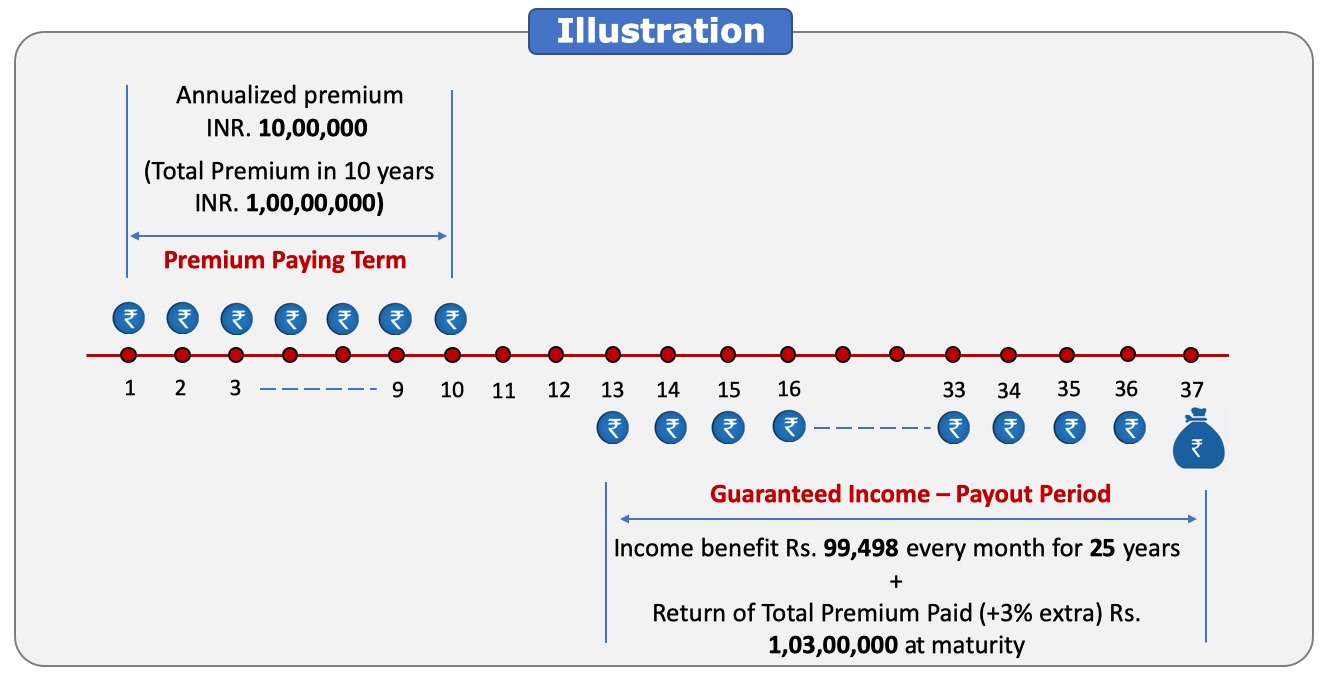

HDFC Life Sanchay Plus Illustrations:

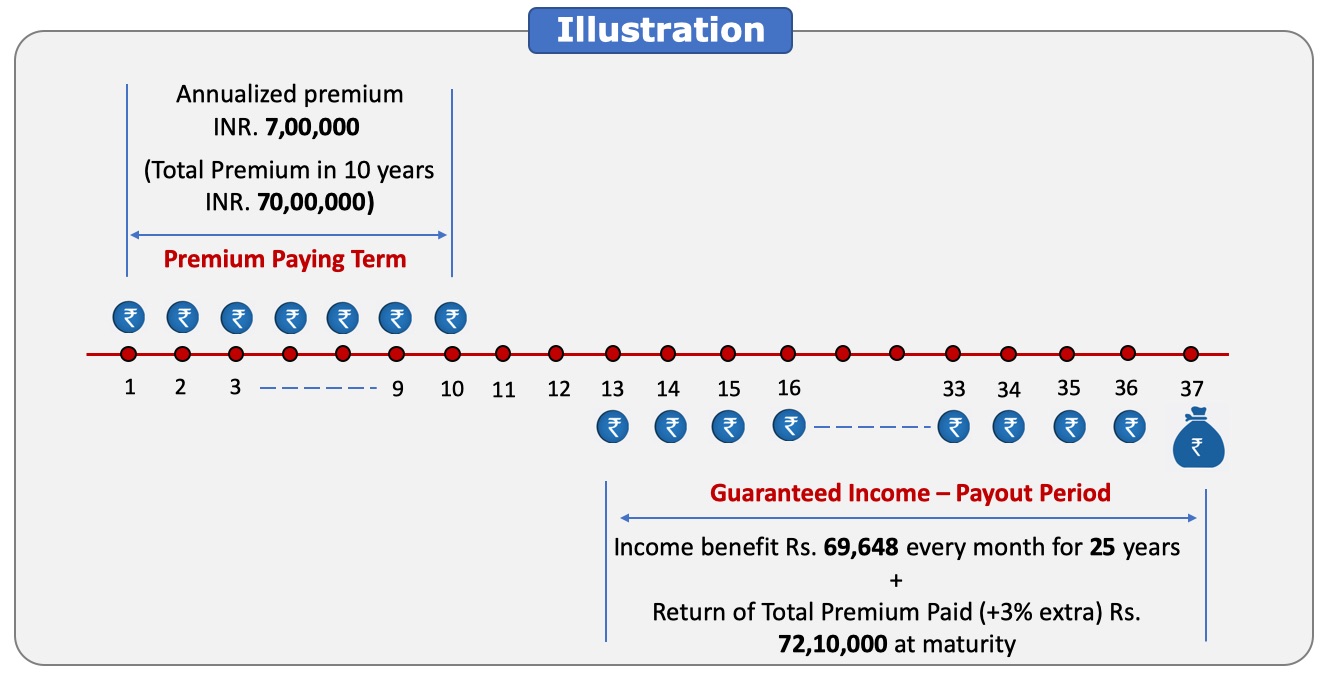

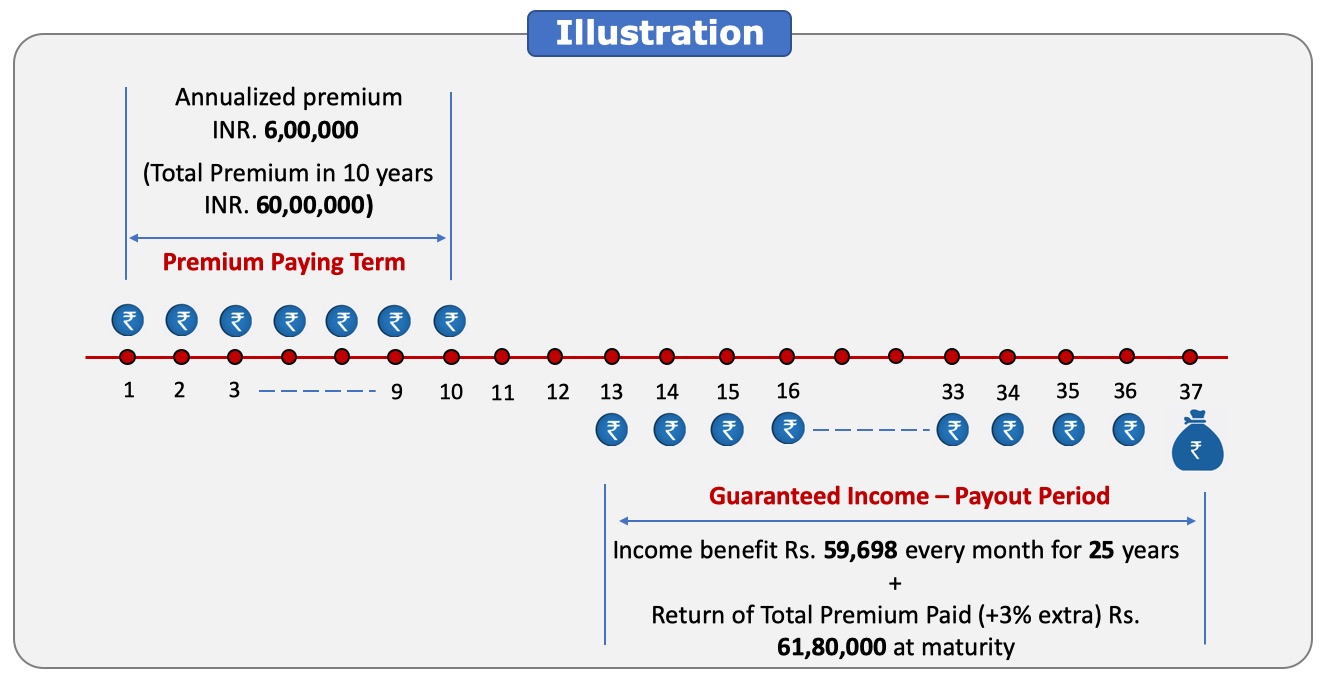

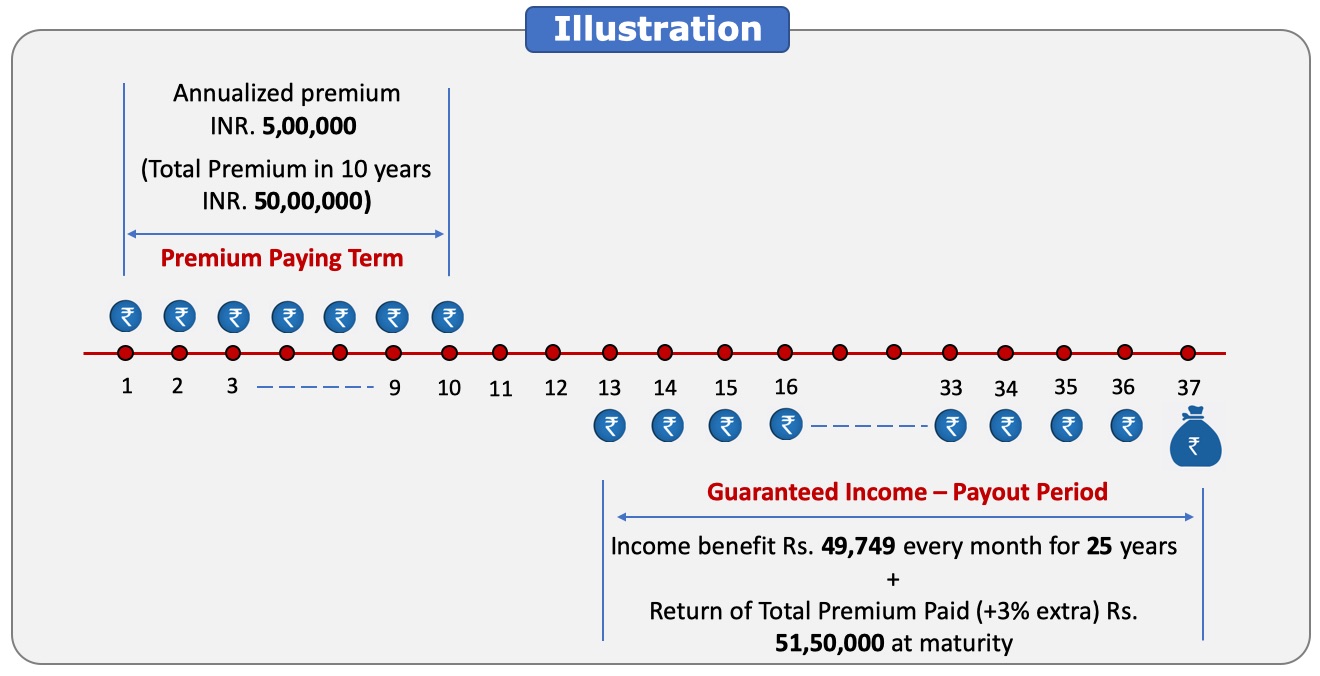

Gender: Female | Age: 35/40/45/50/55 years (same returns are applicable to any age till 55) | Premium Payment Term: 10 years | Policy Term: 12 years | Mode: Annual | Income Payout Frequency: Monthly

(Note: options are available for shorter Premium Paying Terms - 5, 6, 7, 8, 9 years)

IRR (Internal Rate of Return) : approx. 6.82%

Premium: 7 lakh

Premium: 6 lakh

Premium: 5 lakh

Premium: 4 lakh

Premium: 10 lakh

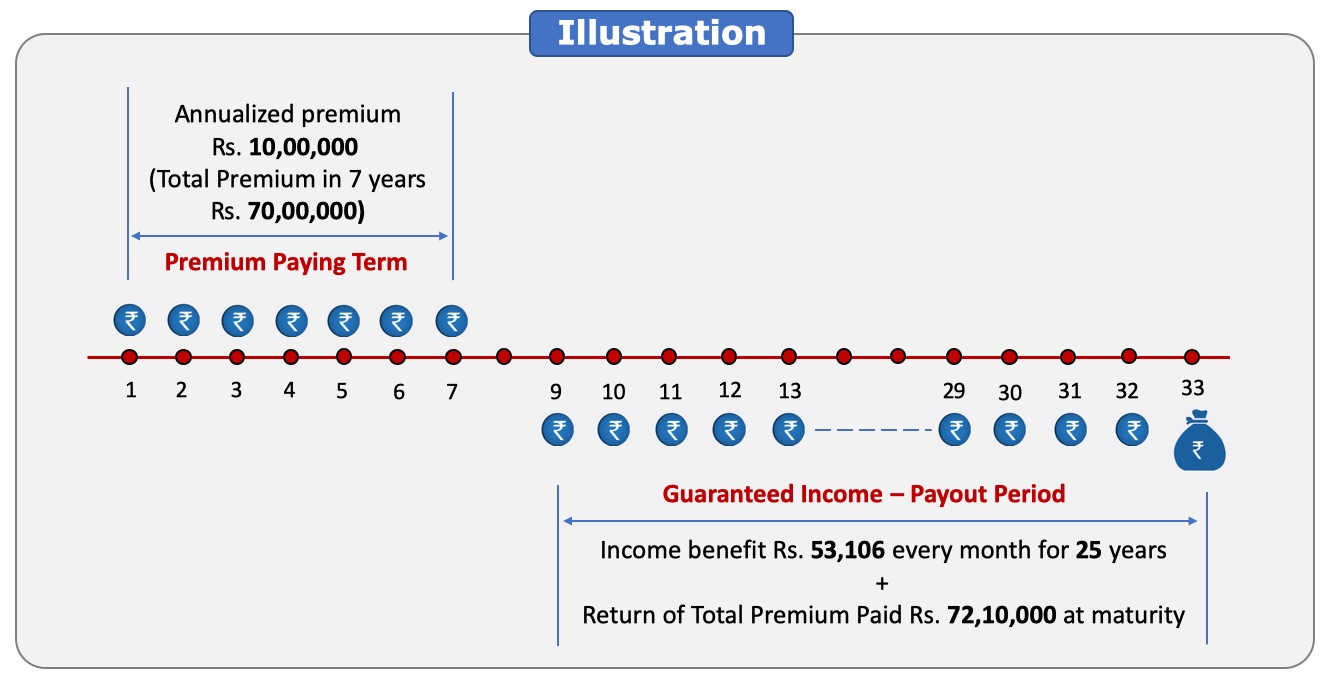

Gender: Male | Age: 35/40/45/50/55 years (same returns are applicable to any age till 55) | Premium Payment Term: 7 years | Policy Term: 8 years | Mode: Annual | Income Payout Frequency: Monthly

IRR (Internal Rate of Return) : approx. 6.45%

Premium: 10 lakh

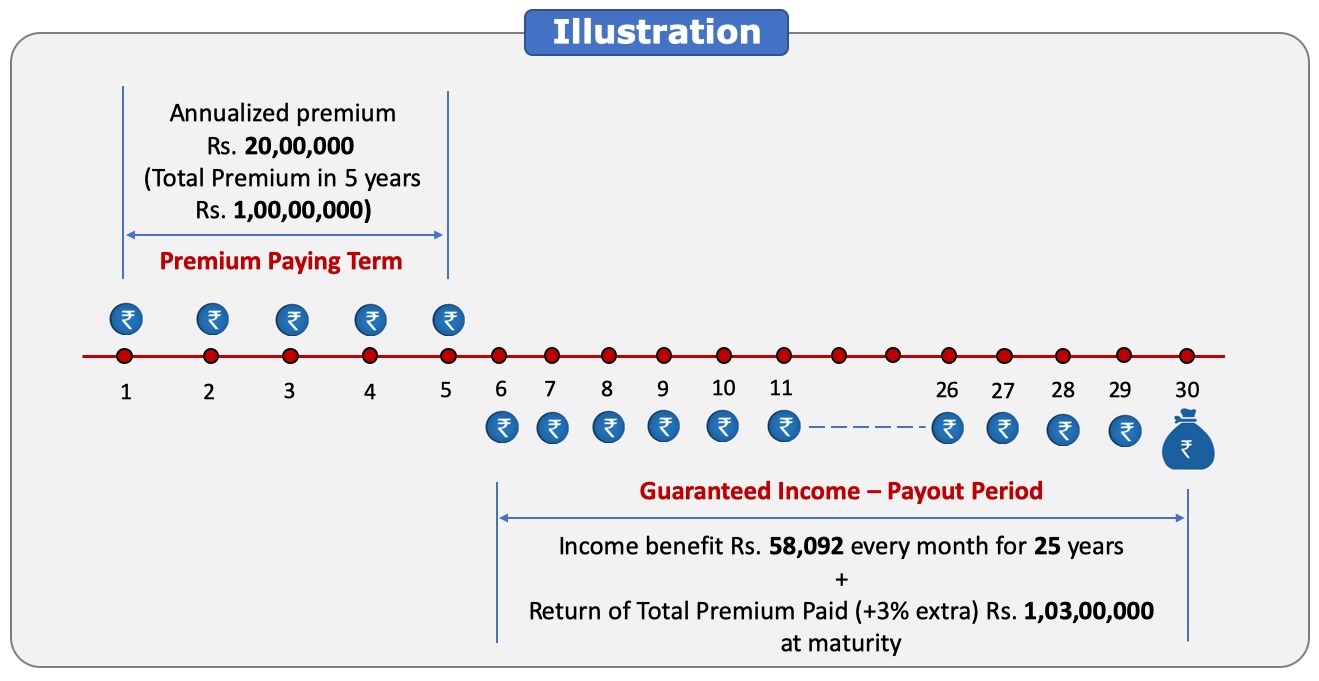

Gender: Male | Age: 35/40/45/50/55 years (same returns are applicable to any age till 55) | Premium Payment Term: 5 years | Policy Term: 5 years | Mode: Annual | Income Payout Frequency: Monthly

IRR (Internal Rate of Return) : approx. 5.85%

Premium: 20 lakh

Downloads

HDFC Life Sanchay Plus Brochure

We also offer Guaranteed Long Term Income Plans from

- MaxLife

- ICICI PruLife

- Bajaj Allianz